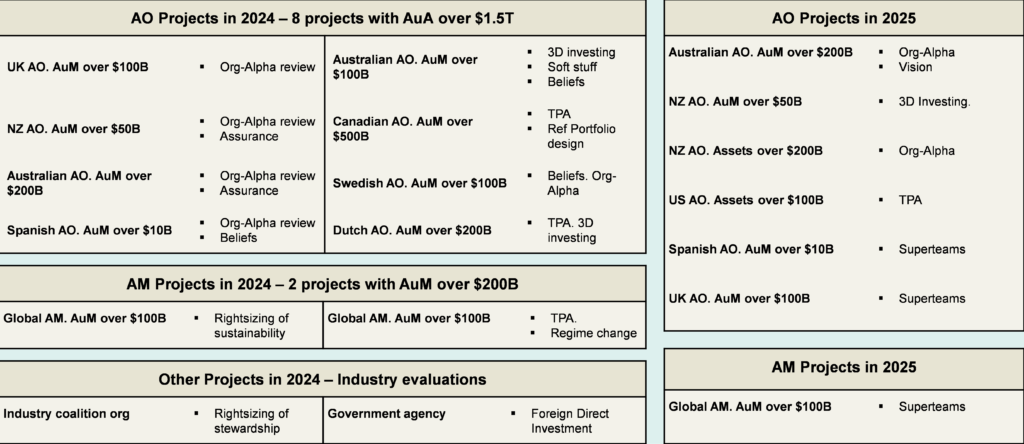

Projects are a high priority for the Institute team and lie at the core of acting on our mission to give investors foresight to build long-term value. We believe that by applying Institute research to your organisational context we can provide new perspectives to help improve organisational effectiveness and competitive edge.

Over the few past years, we have collaborated with various organisations to help them optimise their organisational alpha, driving better portfolio outcomes and enhancing value creation.

These were TPA projects we ran with two large Australian funds:

TPA & Org alpha

Project scope: Review the vision and goals in light of a new-era landscape. Develop the TPA system to suit and the pillars that enable TPA, notably governance.

TPA & 3D Investing

Project scope: Review fundamental beliefs. Build out the TPA system with sustainability robustness and systemic resilience, and align the governance and the risk model.

We’ve engaged on a range of investment and human-capital-related topics, producing a number of toolkits that can be tailored and applied to member contexts through projects. Below are some examples of our work:

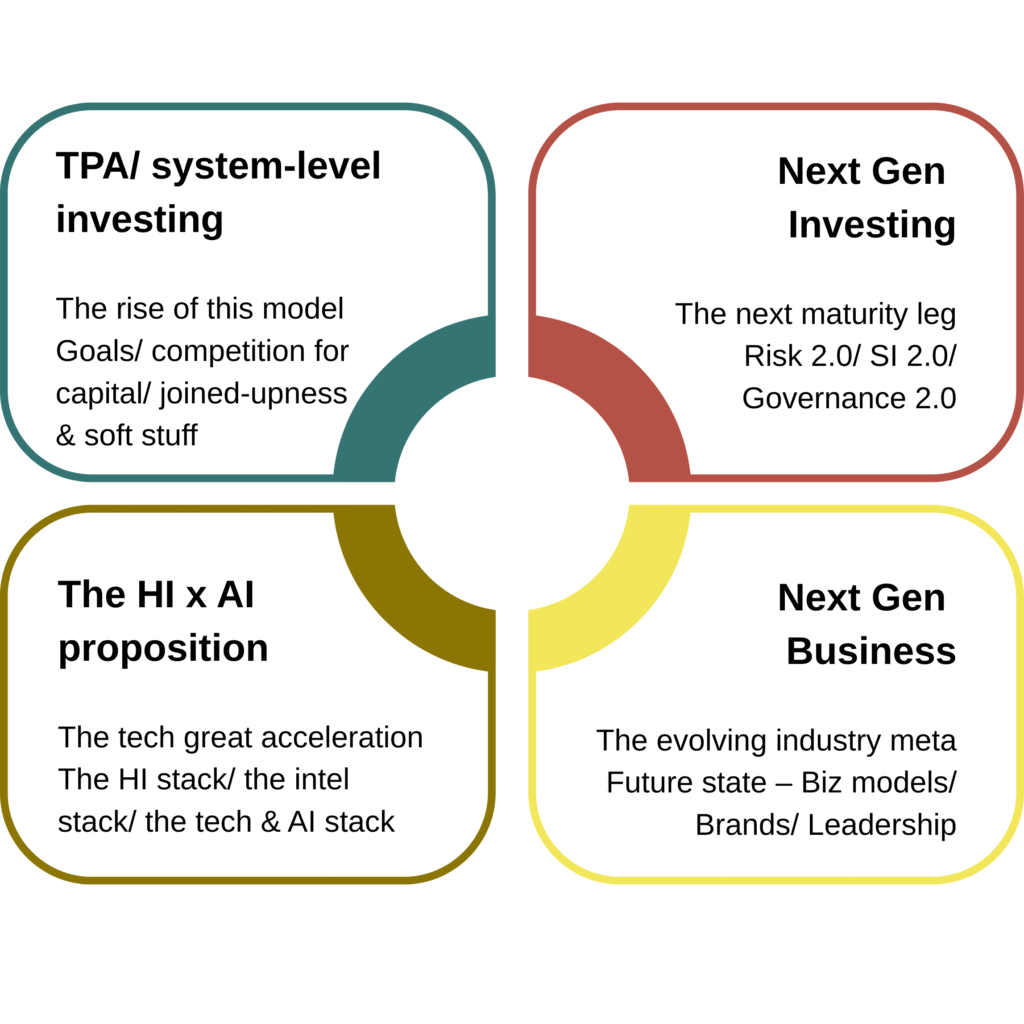

While not exhaustive, here are a list of potential session topics to choose from, grouped under three broad headings.

Curious about what project we could run? Email us and we can explore.

Some projects are included in Institute membership but are available to non-members for a fee.

1. Strategic and market insights

- Horizon scanning (new)

- Global industry studies

- Systemic risk

- Extreme risk

- Asset classes of tomorrow: Chinese capital markets, when securitisation meets blockchain, private equity

- MPT vs systems thinking

- Investment technology of the future

Find related resources

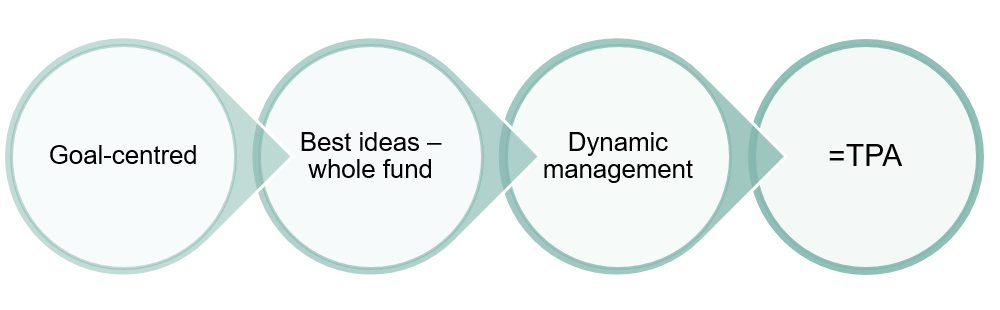

Spotlight on: Total portfolio approach (TPA)

Total portfolio approaches have been evolved by some leading organisations around the world as a more ‘joined up’ investment philosophy that results in a more streamlined approach to portfolio construction. At the Institute we assert that TPA is more efficient at delivering risk-adjusted returns and long-term outcomes. If you’re looking to implement TPA in your organisation, you may find our TPA best practice checklist helpful. Additionally, if you would like us to work with your organisation on TPA education and application, please contact us.

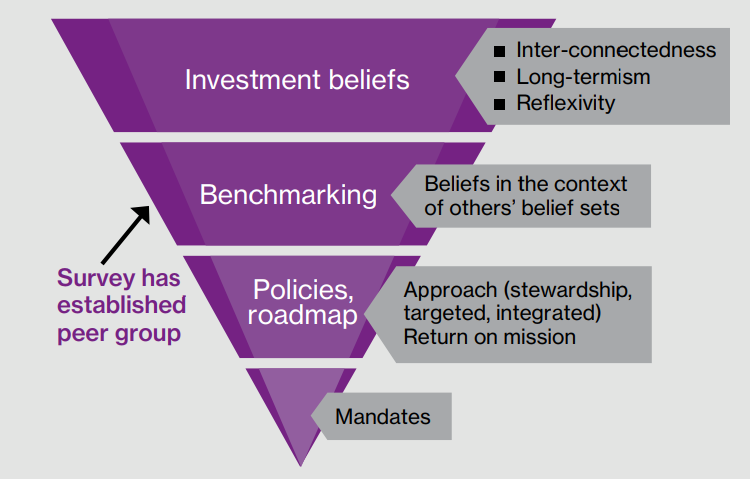

Spotlight on: Benchmarking

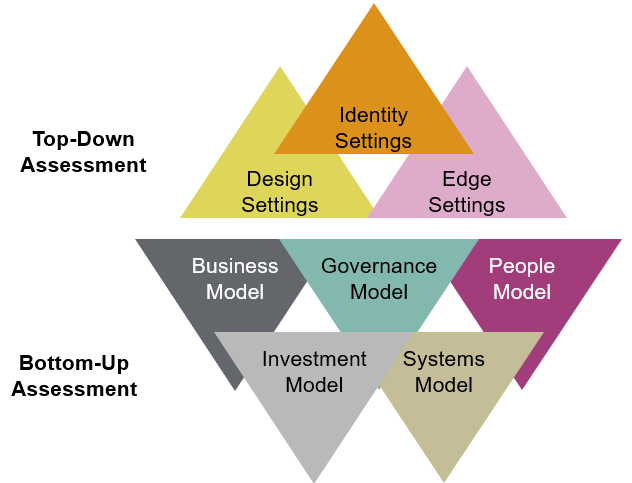

Thinking Ahead Institute have developed a benchmarking tool for assessing the attainment of asset owner best practices. This benchmarking exercise employs two lenses, top-down and bottom-up, to build a mosaic of the key elements of an organisation. In this way we can support organisations in connecting dots, recognising patterns and socialising solutions. Here is an example of such a review. If you would like us to work with your organisation on a benchmarking exercise, please contact us.

2. Organisational governance, culture and effectiveness

- Right-sizing ESG (new)

- Future of work

- Transformational change

- Investment beliefs

- Power of culture

- Diversity, equity and inclusion

- Power of teams

- Total portfolio approach (TPA)

- Decision making

- Investment organisations of tomorrow: the asset owner of tomorrow, the asset manager of tomorrow

- Best practice governance

- Organisational identity

- Leadership

- Performance measurement

- Management of measurement

Find related resources

Spotlight on: Organisational SWOT dashboard

A SWOT (Strengths, Weaknesses, Opportunities, Threats) dashboard for asset managers to assess how well organisations are positioned to navigate current and future industry challenges.

Combining public data, AI-enabled analytics, and survey insights, the dashboard will deliver a comprehensive, forward-looking narrative for each organisation.

Spotlight on: Power of culture

Culture is an under researched, under measured and widely under rated change lever that empowers leadership for change and increases differentiation across our industry. Since 2017 we’ve assessed the culture of around 30 investment organisations which has helped them to better understand their own cultural signature, where they sit on a spectrum and how they could sharpen their own competitive edge. This involves the use of a bespoke dashboard, which scores and communicates your cultural attributes and competitive edges as well as the level of engagement with culture at the organisation. If you are interested in conducting this project with your organisation, please contact us.

We often talk of culture as a secret sauce and that is apt…The technical parts of the investment challenge have been substantially shaped over several decades, the human parts have further to travel.

Roger Urwin

Spotlight on: Governance

Asset owners and asset managers worldwide are being confronted by multiple stakeholders to take on greater responsibility and be more influential in the investment chain than ever before. This has added significant complexity to decision making and raises hard questions about resourcing and whether their governance arrangements are still fit for purpose. The Institute can help your organisation determine whether your governance arrangements are best practice, to learn more please contact us.

It is widely believed that the unpredictability of investment returns means the investment industry cannot control outcomes. Is that really true? Or, are we just not trying hard enough?

Thinking Ahead Institute

3. Sustainability

Find related resources

Spotlight on: 3D investing

At the Institute we believe that our shared future will be one of 3D investing, where we manage risk, return and impact. In order to do so a lot needs to change within investment organisations. The industry will need increased training budgets and a reshaping of the workforce. There will be a significant growth in the number of 3D mandates. This 3D thinking and mandates will be a source of growth for the industry. If you want to know more about 3D investing in principle and practice please contact us.

The decade ahead promises to be one in which purpose gets to be much more widely entrenched and influential. And asset owners have a role to play in the path to purposeful capitalism.

Roger Urwin, Co-founder of the Thinking Ahead Institute

Spotlight on: Investment beliefs

The complexity of implementing a strategy for sustainability is considerable. Given the impossibility of reducing market behaviour and portfolio uncertainty to a series of equations, a system of beliefs is needed as the foundation of an accountable, methodical investment process. The Institute team can help your organisation assess the effectiveness of your belief systems and reimagine the beliefs themselves. If you are interested, please contact us.