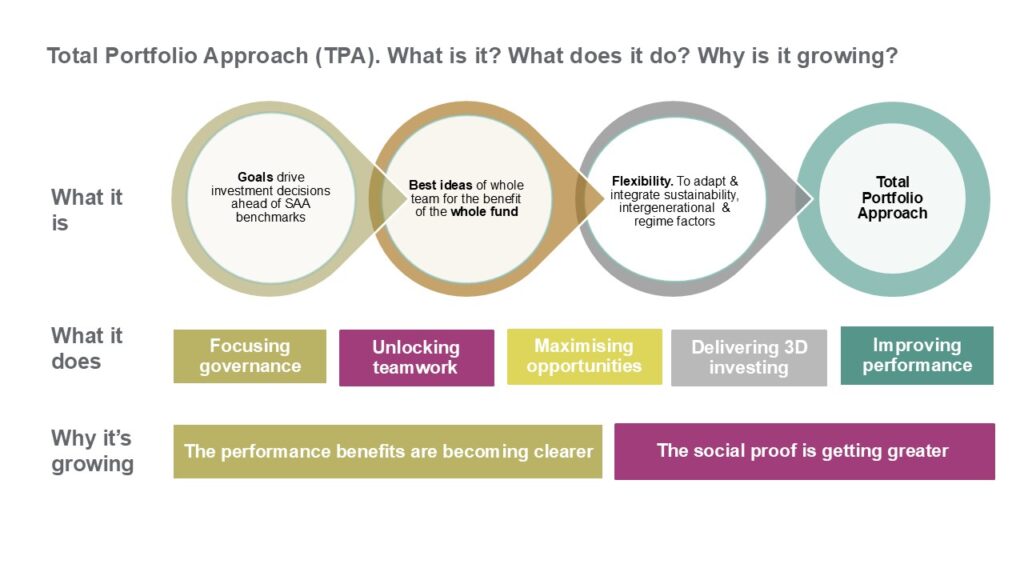

The Total Portfolio Approach (TPA) is a forward-looking investment strategy that marks a significant evolution from the traditional Strategic Asset Allocation (SAA) model. Rather than managing asset classes in isolation with fixed benchmarks, TPA takes a holistic, dynamic, and goal-oriented view of the portfolio. It aims to optimise overall outcomes by integrating all investment opportunities in alignment with the fund’s broader objectives.

TPA has been successfully implemented by several leading funds, demonstrating its ability to deliver better returns. Thinking Ahead’s Global Asset Owner Peer Study showed that TPA adopters have achieved an average performance edge of 1.3% per annum over SAA adopters over a ten-year period.

In more detail, TPA shifts the focus from rigid asset allocations to a unified strategy where decisions are guided by the fund’s overarching goals. It draws on the best ideas from across the entire investment team to benefit the whole portfolio and introduces the flexibility to adapt to emerging priorities—such as sustainability, intergenerational equity, and evolving economic conditions.

This approach enhances governance, fosters collaboration, unlocks new opportunities, and supports more multidimensional “3D investing.”

As the performance benefits become more evident and a growing number of institutions adopt TPA, the model is gaining momentum, bolstered by increasing social proof and shared success stories across the investment community.

Thinking Ahead Institute have assisted several funds on their journey towards TPA. If you’re navigating the transition from SAA to TPA, you may find our TPA spectrum a helpful resource. It outlines the range of models and key considerations to support the shift.

If you would like us to work with your organisation on TPA education and application, please contact us.

We’re expecting a growing number of well-governed asset owners to take the TPA route. Make the transition. Contribute to a quiet revolution in investment practice.

Roger Urwin, Co-founder at the Thinking Ahead Institute

The Total Portfolio Approach is gaining prominence as a transformative investment framework, offering enhanced responsiveness and alignment with institutional objectives. It is revolutionising the future of long-term investing.

Marisa Hall, Head of the Thinking Ahead Institute

Related pages

Take our quiz

- Going Electric: Transitioning from strategic asset allocation (SAA) to total portfolio approach (TPA)

- Total portfolio approach (TPA): Curating the perfect playlist

- TPA’s flexibility keeps OPTrust focused on ‘the mission that matters’

- More funds consider TPA despite challenges

- CalPERS board ponders the risks of TPA

- NZ Super on why a total portfolio approach can both help and hinder PE portfolios

TAI project case studies: TPA

If you’re interested in running a project with us or finding out more about the types of projects we run, take a look.

Project scope: Support the client in reframing its investment policy from SAA to TPA, including the development of a Balanced Scorecard. Also assessed the effectiveness of the CIO role under the new TPA model.

North America

Project org’s AUM: $94bn USD

Project scope: Advise the client on how to improve dynamism, develop a top-of-house function, align governance and enable cost-of capital.

UAE

Project org’s AUM: Over $100bn USD

Project scope: Support the client in benchmarking global TPA standards, diagnosing current TPA practices and developing recommendations to extend the current TPA framework beyond private markets to include public markets.

APAC

Project org’s AUM: $903bn USD

Project scope: Support the client in a multi-stage transition to embed sustainability and TPA principles, using innovative risk models and strategic alignment

with SDGs.

EMEA

Project org’s AUM: $270bn USD

Key resources

Why now is the time to adopt the total portfolio approach. View the PDF.

A practical guide to implementing total portfolio approach. View the PDF.

This Thinking Ahead Institute presentation outlines the Total Portfolio Approach (TPA), a dynamic, goal-driven investment strategy that outperforms traditional SAA, with insights on transition, performance, and real-world success.

More funds consider TPA despite challenges

Read Roger Urwin’s article featured on on Top1000funds.com.

Total Portfolio Approach Study (TPA)

This study of leading asset owners confirms that both in theory and in practice, TPA offers theoretical advantages over the more traditional Strategic Asset Allocation (SAA) approach.

In this paper, we urge for a switch of thinking to better connect the total portfolio with the fund goals.

Global Asset Owner Peer Study on best practices

The Global Asset Owner Peer Study on best practices is an examination of 26 prominent asset owners from around the world, conducted in partnership with Future Fund. In which TPA is discussed as best practice.

It’s a drag: why TPA is superior to SAA

A total portfolio approach (TPA) to portfolio construction has been described as a “more joined up” process.

Building smarter portfolios: a look inside the Total Portfolio Approach

In this episode of Investing for Tomorrow, we’re joined by Sue Brake, former CIO of the Future Fund and Board member at NZ Super Fund and Stephen Gilmore, Chief Investment Officer at CalPERS.

Video: how TPA can be an efficient way of managing a portfolio

Roger Urwin and Johanna Kyrklund, Group CIO at Schroders, discuss integrating sustainability under TPA, adoption amongst large asset owners, considerations of combining public and private assets under TPA and much more.

More resources

*New* Vision to Execution: How Investors Are Operationalizing the Total Portfolio Approach

Report produced in partnership with CAIA Association