The world’s largest 500 asset managers is a joint annual research study conducted by the Thinking Ahead Institute, in conjunction with Pensions & Investments. This edition covers trends and assets under management (AUM) for 2023.

Key industry observations

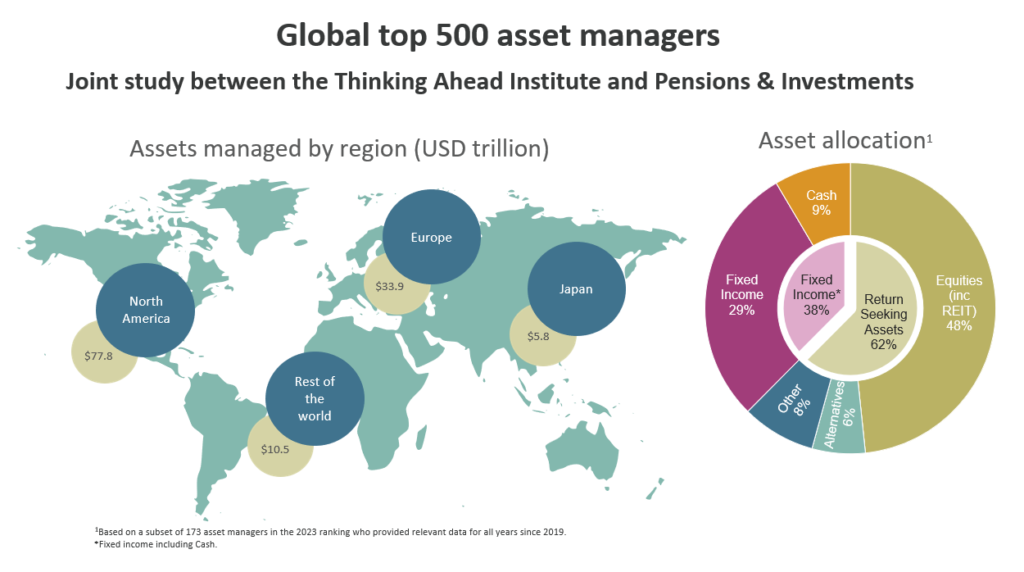

- Total discretionary assets under management (AUM) of the 500 managers ranked reached USD 128.0 trillion at the end of 2023, up by 12.5% from the end of 2022.

- BlackRock remains the largest asset manager since 2009, followed by Vanguard in second since 2012, and Fidelity Investments in the top three for four consecutive years.

- North America experienced the largest growth in AUM with a 15.0% increase, followed closely by Europe (incl the U.K.) with a 12.4% rise. Japan saw a slight decline, with AUM decreasing by 0.7%. Managers from the Rest of the World category saw a moderate increase in AUM of 3.2%.

- North America accounted for 60.8% of the total AUM in the top 500 managers, with USD 77.8 trillion at the end of 2023.

- The Top 20 managers’ share of total AUM grew from 44.2% in 2022 to 45.5% in 2023, with their total AUM rising 15.9% to USD 58.2 trillion.

- 14 U.S. managers make up the Top 20, accounting for 80.3% of the top 20 AUM, while the remaining are European managers.

- Of the Top 20, 12 are independent asset managers, 6 are banks, and 2 are insurer-owned managers.

- Equity and Fixed Income remain the dominant asset classes, comprising 77.3% of total AUM (48.3% equity and 29.0% fixed income). This marks a slight decrease of 0.2% compared to the previous year.

- Investment in passive strategies now accounts for 33.7% of the total, marking a 6.1% increase in its share of investments. Actively managed assets represent 66.3%, which is a 2.9% decrease from the previous year.