The Asset Owner 100 is a Thinking Ahead Institute study which gathers data on the total assets of the top 100 asset owners around the world. Though not included in the ranking, the study also presents the total assets for the top 10 insurers and the top 10 foundations and endowments.

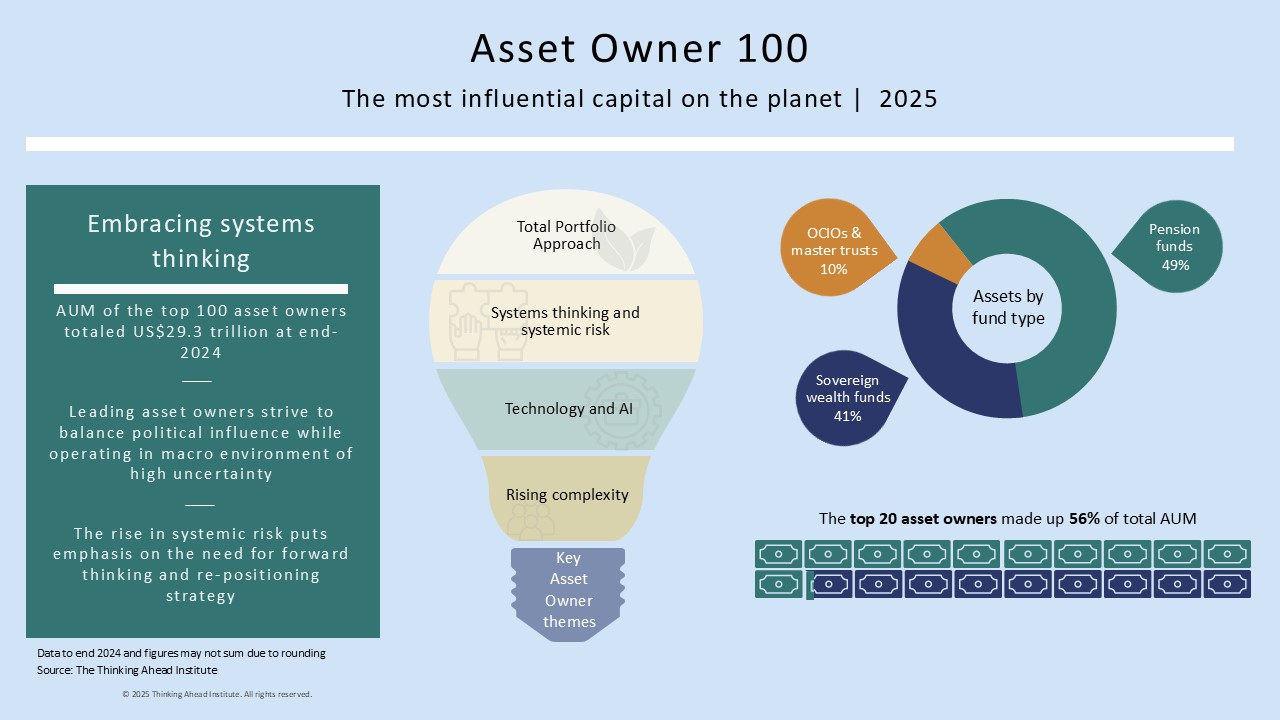

The study reveals the world’s 100 largest asset owners are now responsible for US$ 29.3 trillion as of the end of 2024; experiencing an increase in assets of 11.3% compared to the previous year.

A new leader emerged in the top 100 global asset owners as Norway’s Norges Bank Investment Management, Norway’s sovereign wealth fund, reached $1.7 trillion in assets under management, toppling the former long-term frontrunner, Japan’s Government Pension Investment Fund, which manages $1.6 trillion and is now at second place.

The new section of the report includes our analysis of allocations to alternative assets. Alternatives now represent 28.4% of total assets, with private equity standing out as the dominant allocation across all regions.

The new research also covers other key themes for asset owners to address, which include:

- The global economy in 2025 is moving from a period of persistent inflation toward a more stable, though still uneven, macro environment. Looking ahead, asset owners face a landscape of moderate global growth, aided by policy support, but still exposed to risks from renewed inflation pressures, shifting trade dynamics, and geopolitical developments.

- Traditional, siloed investment approaches are showing limitations in today’s complex markets. The Total Portfolio Approach (TPA) is growing in popularity as it allows funds to make investment decisions based on a holistic view of overall portfolio outcomes, not just individual asset class performance.

- Artificial intelligence (AI) is becoming a practical tool across investment organisations, increasingly supporting portfolio management, research, risk analysis, reporting and client communication.

- Traditional risk management relying heavily on historical data and linear models struggles to keep up with today’s complex, interconnected risks. Risk 2.0 is a conceptual framework to better identify, understand and manage all risks particularly those that arise from complex, systemic sources with limited historical precedent.

Full report

The full report is available now to our members. If you are not a member but would like to view the full report, please reach out to us via email: enquiries@thinkingaheadinstitute.org