The Asset Owner 100 is a Thinking Ahead Institute study which gathers data on the total assets of the top 100 asset owners around the world. Though not included in the ranking, the study also presents the total assets for the top 10 insurers and the top 10 foundations and endowments.

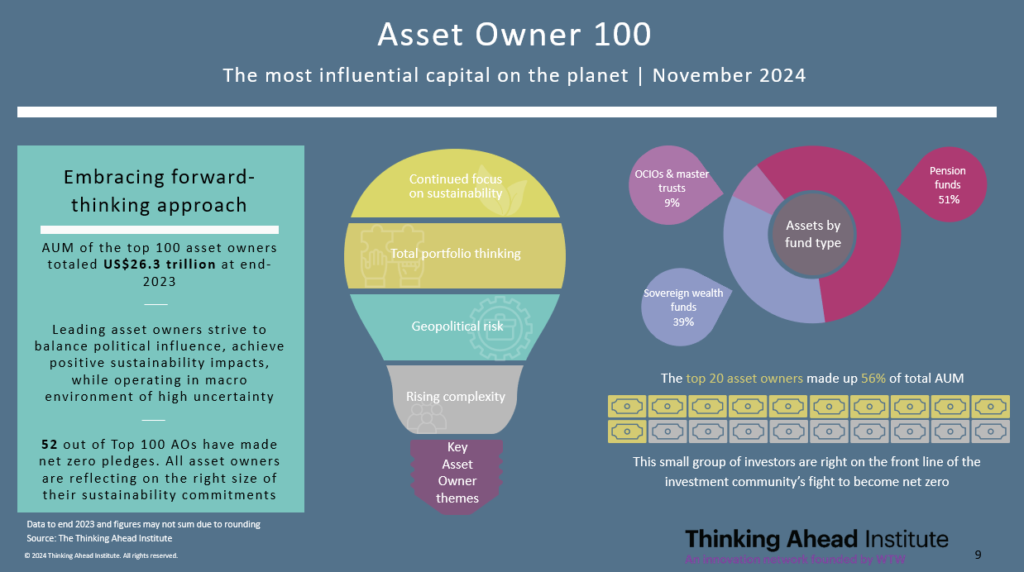

The study reveals the world’s 100 largest asset owners are now responsible for US$ 26.3 trillion as of the end of 2023; experiencing an increase in assets of 12.3% compared to the previous year. Sovereign Wealth Funds (SWFs) remain a dominant force among other types of asset owners, now managing 38.9% of the assets among the AO100. In comparison, pension funds, while still forming the largest assets under management by fund type (51.2%), saw the smallest growth rate, with assets held rising by 8.9% from the previous year.

Asset owners have navigated a year of volatility and mixed performance across asset classes. Interest rates reached significant highs in 2023. After a sustained period of elevated rates aimed at controlling inflation, central banks began to implement gradual rate cuts in the latter half of 2024, marking the first reductions in years. However, market volatility remains high with uncertainty due to geopolitical events and several major elections.

The report also focuses on the rising complexity of the investment landscape due to rising uncertainty, expanding regulations, and the involvement of a growing number of stakeholders, each with unique interests and expectations. Geopolitics has become a leading driver of market risk, but in common with other risks that are systemic its integration into the investment process has been a challenge.

The new research also covers other key themes for asset owners to address, which include:

- The net zero investing landscape remains complex, requiring a portfolio-wide approach and strong collaboration between asset owners and managers

- The investment industry is increasingly subject to political influence as governments leverage policy and regulation to shape financial strategies that align with national priorities

- Asset owners are increasingly recognising the importance of artificial intelligence (AI) and data-driven strategies to enhance their investment processes and organisational effectiveness

- Traditional risk management relying heavily on historical data and linear models struggles to keep up with today’s complex, interconnected risks. Risk 2.0 is a conceptual framework to better identify, understand and manage all risks particularly those that arise from complex, systemic sources with limited historical precedent