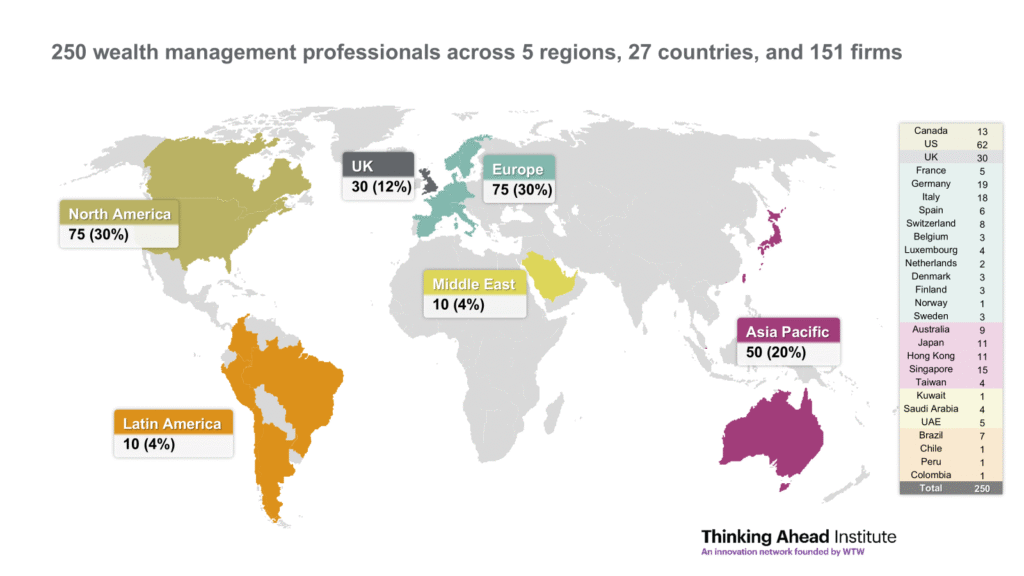

The Global Wealth Study 2025 gathered the views of 250 global wealth management professionals via an extensive online survey conducted in July 2025 capturing more than 50,000 data points.

The sample includes firms operating in the wealth space across 5 regions and 27 countries – each with at least $500 million in assets under management – including family offices, wealth managers, private and investment banks, wirehouses, independent financial advisers, and broker/dealers.

The underlying firms’ client base is skewed toward high-net-worth levels, with the median investor being a mid-tier millionaire holding approximately $5.5 million in assets.

The study explores key topics such as wealth matters, how wealth management firms position themselves in the marketplace, what wealth portfolios are made of and how they come together.

Key findings

Wealthy investors

- 70% prioritise investing over significant life events such as retirement or succession

- 60% cite capital accumulation as the leading priority ahead of other life goals

- 70% cite business ownership as main source of wealth, followed by inheritance (61%)

- 47% see macro and geopolitical risks (41%) as the biggest threats to their wealth

Wealth firms

- 50% report managing the majority of clients with full investment discretion

- 46% see meeting clients’ life goals and aligning capital with values (45%) as core to their wealth philosophy

- 76% plan to expand investment management and financial advice (74%), reinforcing core services to meet client’s needs

- 40% expect talent shortage to be their top business challenge

Wealth portfolios

- 72% show strong preference for SAA, long-term low turnover (62%), thematic (52%)

- 58% cite performance as the top driver of both manager and vehicle selection

- 59% see tech as both the biggest disruption ahead and leading investment opportunity (65%)

- 20% allocation to private markets (PE, PD), but cost (57%), liquidity (52%) and transparency (51%) remain major barriers

While you’re here, be sure to listen to our latest podcast episode, The Future of Wealth, discussing the “Great Wealth Avalanche” at a time of profound demographic and cultural change.

The wealth firm of tomorrow must balance the stewardship of capital with its growth, embracing a holistic approach to wealth

Andrea Caloisi,

Associate Director, Thinking Ahead

Can technology lower the barrier to access financial advice?… Advice that will make them spend their money in a better way and be able to reach their long-term financial goals.

Ellie Lloyd Jones,

Director, WTW Investments and Strategic Development Support, atomos wealth

Related pages

Read our latest

Investment Insight

Towards a better map of the wealth industry’s ecosystem (members only)

Podcast: The future of wealth

Global Wealth Study reports:

Full report

Summary

Further information

“Wealth allocation to private markets set to stagnate unless key issues are addressed” – read our press release on the global wealth study