Wealth has been a central focus of Thinking Ahead’s research over the past year, culminating in the publication of our Global Wealth Study – an extensive global survey of 250 wealth management professionals across 27 countries, from firms with at least $500 million in AUM. As we continue to explore the wealth space, this piece offers a framework to better interpret emerging signals and understand what’s next for wealth.

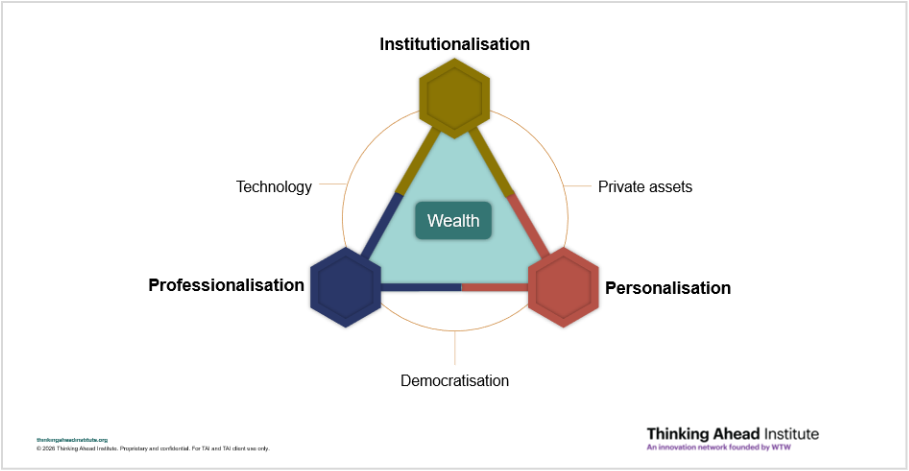

As illustrated in the graphic below, wealth sits at the centre of a set of attractive and repulsive forces that continuously shape it. At a high level, this system can be articulated around a triangulation of three long-running forces:

- Institutionalisation – reflected in consolidation, operating model evolution, and the increasing routinisation of institutional-grade capabilities

- Personalisation from clients and investors rising in demand, as expectations shift toward more tailored, responsive, and meaningful wealth experiences

- Professionalisation – on the supply side this is most visible in the growth of family offices and other specialist wealth actors.

Institutionalisation

Institutionalisation reflects a well-known structural shift in wealth management, driven by key market dynamics. On the inorganic growth side, consolidation continues at pace, with transaction activity more than doubling over the previous decade. At current run-rates, according to official market data, this is expected to result in up to a 20% reduction in the number of asset and wealth managers over the next five years1.

On the organic side, sustained investment in technology and operating-model redesign, including governance and data management, has moved from being discretionary to being essential. Less than one-third of industry AUM growth over the past decade has been generated organically2. Looking ahead, one-third of the wealth firms we spoke with in our study last year said expanding or developing new services and capabilities is among their top business priorities over the next two to three years.

As wealth increasingly intersects with private markets, regulatory complexity, and global client needs, institutional-grade capabilities become the new normal.

Personalisation

Wealth is increasingly viewed not in isolation as a pool of investable assets, but as something that supports life goals over time – across accumulation, protection, usage, and transfer.

Personalisation here points to something more holistic: a whole-of-life, whole-of-balance-sheet approach to wealth. One that attempts to integrate investments with liabilities, businesses, family structures, and wellbeing considerations.

This largely remains aspirational and unexplored by the industry, mainly because it is less about bespoke products and more about continuous financial care – adapting as circumstances, priorities, and risks evolve across the life course.

Professionalisation

Professionalisation is the process of maturation of governance, decision-making, and operating standards across the wealth ecosystem and its players. It is visible in the increasing formalisation of investment processes, risk management, fiduciary oversight, reporting, and talent models – particularly within family offices. Market evidence suggests this is scaling rapidly, with family offices expanding in number, assets, and sophistication, and estimates pointing to 75% increase in their number by 20303.

Bringing the forces together

Moving away from these forces in isolation, insights emerge when we look at their interaction.

For example, take institutionalisation. It suggests capital pooling, scale, and standardisation. Now introduce personalisation. Here, a fundamental tension emerges – pooling capital improves efficiency, governance, and access, while personalisation brings differentiation, flexibility, and bespoke outcomes.

This leads us to a first core research question: to pool or not to pool? And if pooling, how? Which models are genuinely scalable? What roles do separate structures, platforms, and service layers play? And ultimately, what shape does personalisation actually take in an increasingly institutionalised wealth space?

With this example in mind, we can more clearly introduce the themes we at Thinking Ahead intend to explore right at the intersection of these forces – private assets, technology, and democratisation.

Private assets

Private assets in wealth portfolios are fundamentally an institutional story, yet demand is increasingly driven by personalisation and client-specific objectives. This creates unresolved tensions around access, governance, liquidity, and suitability that existing wealth models only partially address.

Private markets are, in effect, “going public” through wealth channels. As private markets become increasingly crowded at the institutional level, asset managers are turning to wealth as the next growth opportunity4. This shift raises critical research questions around how institutional products are adapted for non-institutional contexts.

The emergence of evergreen and semi-liquid structures is exemplary. Early adoption is already visible in markets such as the UK, with growing exploration across wealth platforms.

From a research perspective, the key issue is not just access, but integration. What liquidity terms, governance standards, sizing constraints, and advisory frameworks are required to ensure these structures improve risk-adjusted outcomes rather than introduce fragilities? This is where professionalisation perhaps comes in as a critical layer of assessment.

Technology

Technology is arguably a research topic in its own right and will require deeper exploration across several areas: AI, AI agents, digital platforms, digital assets, and tokenisation.

AI is increasingly positioned as a way to industrialise personalisation – think about transforming deep client understanding, planning, and ongoing monitoring into something that can scale without exploding costs. Tokenisation and digital platforms, meanwhile, sit closer to the infrastructure layer, enabling fractionalisation, faster settlement, improved transparency, and even new fund formats. As we write, over $23 billion in real-world assets have been digitised in the form of tokens5.

Crucially, the value of these technologies is conditional. Without strong governance and professional control frameworks, they will likely fail to deliver – or actively increase risks, including systemic risk.

Technology sits at the interplay between institutionalisation, hyper-personalisation, democratisation of access, and operational upgrade.

Democratisation

Democratisation is best understood as an emergent property of this entire ecosystem rather than an end goal in itself. In theory, it is a system-level outcome that arises when institutionalisation, professionalisation, and technology align. In practice, democratisation at scale is impossible without adequate institutional and professional pillars because the system must carry suitability, education, operational resilience, and liquidity governance for a broader investor base. This is why regulatory frameworks and new fund regimes – such as the European regulations on ELTIF 2.0 and semi-liquid structures – explicitly aim to widen access while managing investor protection constraints.

This leads us to a final set of research questions. What safeguards are necessary to ensure that broader access to sophisticated assets and strategies improves financial outcomes rather than increasing fragility? How can scalable personalisation support diverse client needs without reverting to one-size-fits-all solutions?

To conclude, while the future of wealth remains wide open, it is helpful to frame it through a set of macro forces and emerging trends, and to use them as lenses to interpret change and prepare more thoughtfully for the challenges and opportunities ahead.

Footnotes:

- https://www.oliverwyman.com/content/dam/oliver-wyman/v2/publications/2025/October/oliver-wyman-morgan-stanley-global-wealth-and-asset-management-2025-edition.pdf

- https://web-assets.bcg.com/89/d4/676a2c534cf2aa485011edbc0200/2025-global-wealth-report-june-2025.pdf

- https://www.deloitte.com/content/dam/assets-shared/docs/services/deloitte-private/2024/2024-defining-the-family-office-landscape-report.pdf

- https://www.secnewgate.co.uk/our-insights/private-markets-are-going-public-just-not-through-stock-exchange

- https://app.rwa.xyz/