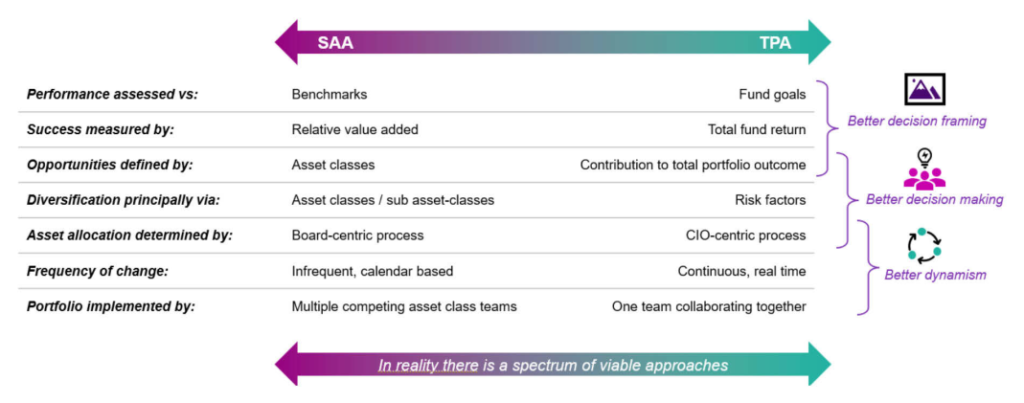

Total Portfolio Approach represents a fundamental evolution in institutional portfolio management, shifting from managing asset class weights to managing total fund outcomes.

TPA continues to gain momentum, with its adoption by prominent asset owners, including PGGM, NZ Super, the Future Fund, and CalPERS, influencing clusters of followers across the industry.

The shift is measurable: SAA adoption has halved since 2017 while 35% of funds in Thinking Ahead’s Global Asset Owner Peer Study now use TPA, outperforming traditional SAA by 1.3% annually over the past decade.

Whether you’re navigating this transition or simply curious, understanding your current position is the critical first step toward deliberate strategic positioning. This 10-minute diagnostic reveals exactly where your fund stands across the key dimensions that differentiate SAA and TPA approaches.

What you’ll gain

The quiz distills the Thinking Ahead Institute’s 20 years of research and hands-on experience on TPA into a framework that provides:

- Objective assessment: data-driven clarity on your fund’s current positioning

- Benchmarking: see how your position compares to the broader industry when we publish interim analysis and aggregate results

- Inform your strategy: use your placement to guide future strategy

How it works

The diagnostic evaluates your fund across four critical dimensions that distinguish SAA from TPA in practice:

People: Team mindset & incentives | What drives decisions

Investment: Performance measures & opportunity sources | How you define success

Governance: Decision authority & implementation | Who owns strategy & execution

Risk: Measurement approach & time horizon | What makes it into your risk framework

Ready to see where your fund sits? The assessment takes less than 10 minutes and delivers instant results.

Stay tuned for our interim analysis, where we’ll share aggregate insights from all survey participants.

The Total Portfolio Approach is gaining prominence as a transformative investment framework, offering enhanced responsiveness and alignment with institutional objectives. It is revolutionising the future of long-term investing.

Marisa Hall

Head, Thinking Ahead Institute

Related pages

- Going Electric: Transitioning from strategic asset allocation (SAA) to total portfolio approach (TPA) – by WTW

- Total portfolio approach (TPA): Curating the perfect playlist – by WTW

- More funds consider TPA despite challenges – by Roger Urwin, co-founder of Thinking Ahead

Latest research content hubs

Thinking Ahead’s case studies: TPA projects

If you’re interested in running a project with us or finding out more about the types of projects we run, take a look.

Project scope: Support the client in reframing its investment policy from SAA to TPA, including the development of a Balanced Scorecard. Also assessed the effectiveness of the CIO role under the new TPA model.

North America

Project org’s AUM: $94bn USD

Project scope: Advise the client on how to improve dynamism, develop a top-of-house function, align governance and enable cost-of capital.

UAE

Project org’s AUM: Over $100bn USD

Project scope: Support the client in benchmarking global TPA standards, diagnosing current TPA practices and developing recommendations to extend the current TPA framework beyond private markets to include public markets.

APAC

Project org’s AUM: $903bn USD

Project scope: Support the client in a multi-stage transition to embed sustainability and TPA principles, using innovative risk models and strategic alignment

with SDGs.

EMEA

Project org’s AUM: $270bn USD