Welcome to the Thinking Ahead Institute’s 2026 research activities

At the Thinking Ahead Institute, we are committed to exploring the forces shaping our industry through collaborative research, shared learning, and deep engagement. Our proposed 2026 research activities are designed to inspire innovation, sharpen strategic thinking, and drive meaningful progress across critical areas of focus.

In the year ahead, we will continue to advance work in key domains including defined contribution (DC) systems, total portfolio approach (TPA), and wealth management. We will also deepen our exploration of long-term thematic trends and improving governance and organisational alpha.

Through targeted projects, one-to-one engagements, and global industry studies, we build on our strong tradition of research excellence—ensuring our insights are both forward-looking and directly relevant to your organisation’s needs.

We encourage all members to actively participate in our research efforts, contribute their perspectives, and connect with peers across the network.

Together, we can shape the future of investment and deliver enduring value to all stakeholders.

Browse by clicking though the topics on the left panel.

- Defined contribution

- Wealth

- Total Portfolio Approach

- Long term thematic trends & insights

- Industry surveys & peer groups

- Projects and 121s

- Our working groups

DC research

Building on the findings from our 2025 Global DC Peer Study, our 2026 DC research will focus on two key areas:

- how post-retirement income solutions can be designed and governed for enduring member benefit

- how private assets can be responsibly and effectively incorporated into DC portfolios.

Together, these themes reflect the growing maturity of DC systems and the need for innovation across design, investment, and implementation.

Please contact Jessica Gao to know more.

Related pages

Global wealth research

Thinking Ahead will build on the 2025 Global Wealth Study insights, prioritising technology, private markets, the whole-of-life approach, and talent, among other areas, to better understand the evolving challenges and opportunities facing global wealth management.

| Theme | From TAI GWS 2025 | To 2026 research exploration |

| Technology | One-third view investment platforms and technology most valuable for wealth transfer One-third foresee difficulties keeping pace with technology and digital transformation | How will tokenisation, digital assets, and AI reshape wealth management portfolios and advisory models? |

| Private markets | Private assets already make up 20% of wealth portfolios in this sample Private markets sit firmly in the investment opportunity set, ranked top after tech | What innovations or product design features could help mitigate the disproportionate risks and challenges posed by cost, liquidity, and transparency? |

| Whole-of-life | 60% cite capital accumulation as their leading wealth priority, ahead of other life goals | Does a whole-of-life, whole-balance-sheet approach significantly increase value by complementing the wealth-growth drive identified in the study? |

| Talent and skills gap | 40% expect talent attraction and retention to be their top challenge over the next 2–3 years | What new skills will be essential for wealth professionals? How can firms attract, develop, and retain talent in the competitive global wealth market? |

Please contact Andrea Caloisi to know more.

Related pages

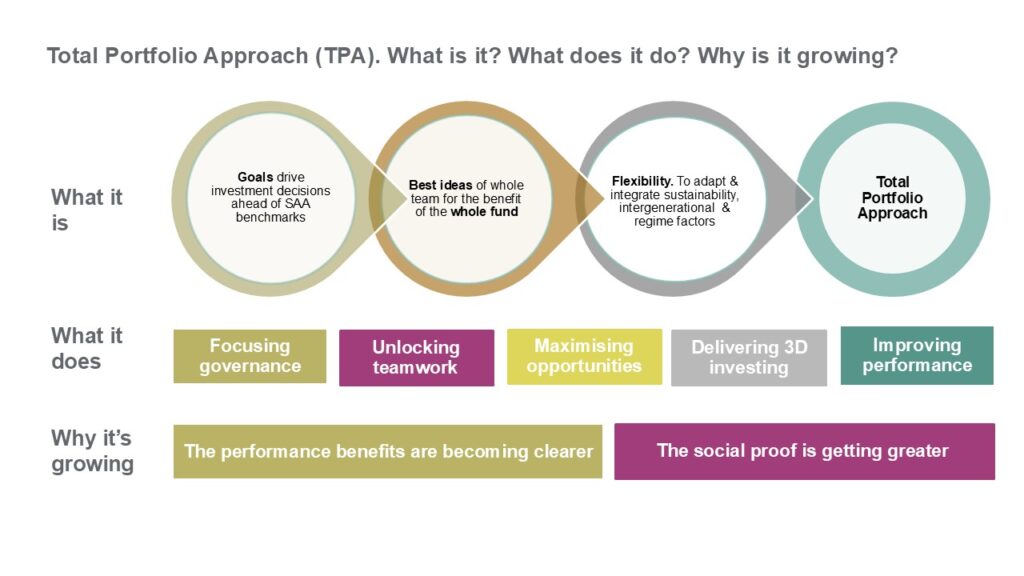

Total Portfolio Approach

In 2026, our work on the Total Portfolio Approach (TPA) will continue through projects with asset owners and asset managers, while also advancing the practical application of TPA across the broader industry.

Priorities include developing ‘turn-key’ TPA models for mid-size and smaller funds, enhancing risk frameworks, and embedding TPA principles through projects with organisations.

Visit our TPA hub

Why now is the time to adopt the total portfolio approach. View the PDF.

A practical guide to implementing total portfolio approach. View the PDF.

Please contact Jessica Gao to know more.

Related pages

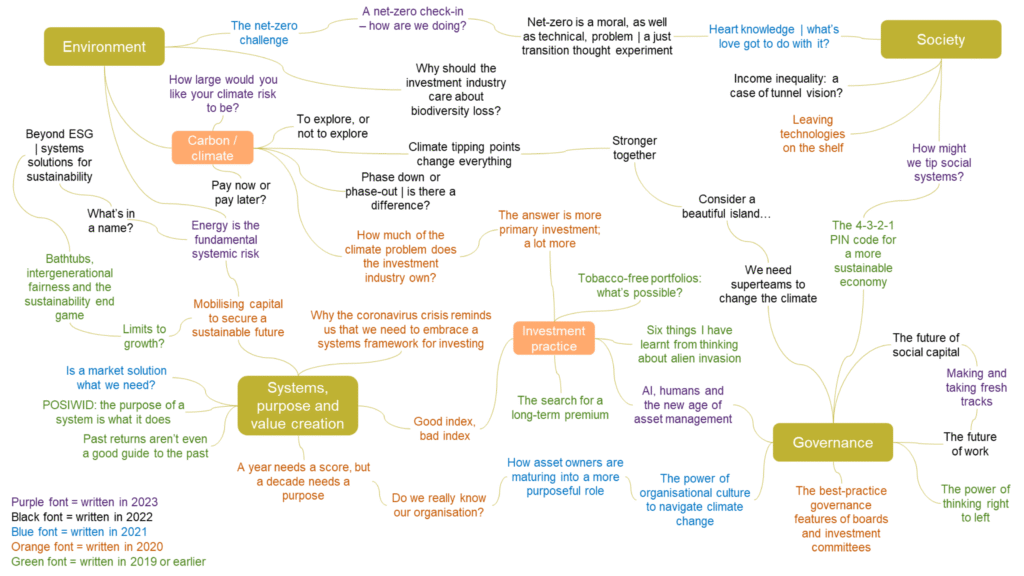

Long term thematic trends and other investment insights

A series of short thought pieces covering a wide range of topics, some related to the main research streams—some addressing questions of current interest, and some more lateral.

To complement these insights, our discussion forums provide a dynamic space for members to exchange perspectives, challenge ideas, and deepen understanding. They are moderated, topic-driven conversations held under the Chatham House Rule to encourage open dialogue.

Proposed topics for the year include:

- Has the correlation between equities and bonds fundamentally changed?

- Is diversification still valuable for long-term investors?

- Is diversity more or less valuable now?

- Are private assets attractive for the next 10 years?

- How might AI affect the above answers (and other questions)?

- Might there be a relationship between the changing structure of pension provision and the vibrancy of the economy?

- How might blockchain and/or tokenisation change investing?

- What is the next generation of smart indices?

Please contact Andrea Caloisi to know more.

Related pages

Industry survey & peer groups

Scale is driving changes in market structure, from mega funds to pooled models. For large organisations, the challenge is managing complexity. For those on a growth journey, it’s about understanding the path to scale. And for others, the key is accessing the benefits of scale without having to become big.

TAI has previously conducted the Global Asset Owner Peer Study, and a Global DC Peer Study. In 2026, we are looking to expand our work through a series of new studies. Proposed studies include:

- OCIO study

- Asset managers’ peer study

- Organisational SWOT analysis study

- Large asset owner studies by region: Maple 8, Super 10, Gulf 6

- Sustainability peer study

Studies will explore how organisations leverage scale across three dimensions: alpha, beta, and organisation, to enhance investment capability, governance, and innovation.

Alpha

- scale in skill-based strategies

- access to private markets

- specialist teams

- monetising skill

Beta

- broader market access

- dynamic beta

- thematic tilts (eg demographics, climate, tech)

- benchmark innovation

Organisation

- internalisation & internationalisation

- organisation maturity model

- governance as organisation grows

- fund structure & pooling model

- technology adoption & integration

Thinking Ahead will also continue its acclaimed industry studies, which are among the most cited and widely read WTW investment reports. Explore our latest editions below.

World’s largest 500 asset managers

Global top 300 pension funds

Ranks the top 500 asset managers; latest edition will include a dedicated section on the role of AI and tech

Tracks the world’s largest pension funds, highlighting asset growth trends and sovereign fund rankings

Global pension assets study

The Asset owner 100

Offers a comprehensive analysis of pension assets across 22 global markets, with deeper insights into the seven largest ones

Ranks the world’s largest asset owners, featuring a new section focused on alternative investments in the latest edition

Please contact Anastassia Johnson to know more.

Related pages

Doing projects with Thinking Ahead

Thinking Ahead love the opportunity to engage with organisations on projects tailored to their needs.

Here are some examples of projects we have done so far:

Review governance design and compare with a best practices model

Focus areas:

Risk 2.0

Fiduciary duty

Org design

Assess current investment framework to enhance TPA thinking and practice

Focus areas:

TPA spectrum

Investment model

Joined-upness

Beliefs review to reflect evolving priorities, remain practical and compare with peers

Focus areas:

Balanced scorecard

Org alpha

Portfolio construction

Optimise alternative investments; higher allocations, greater diversity, and strengthened partnerships

Focus areas:

Asset allocation

Resourcing

Risk drivers

Soft stuff is the hard stuff; align organisational superpowers through collaboration and systems thinking

Focus areas:

Culture & Superteams

HI x AI

Talent

A SWOT (Strengths, Weaknesses, Opportunities, Threats) dashboard for asset managers to assess how well organisations are positioned to navigate current and future industry challenges.

Combining public data, AI-enabled analytics, and survey insights, the dashboard will deliver a comprehensive, forward-looking narrative for each organisation.

Focus areas:

Strategic resilience

Innovation and digital capability

Sustainability and stakeholder alignment

Talent and organisational agility

To schedule your project this year, email us

Our working groups

For our 2026 member working groups, we are exploring a range of topics, including developing measurement models that support the co-creation of new methodologies and outcomes—designed to help institutional investors better navigate uncertainty. Building on this foundation, the group will create practical tools for forecasting, horizon scanning, and strategic dashboards to enhance decision quality and long-term foresight.

Purpose of the research stream

- Advance the thinking and methodology behind scorecards and portfolio quality dashboards.

- Incorporate new metrics derived from strategic discussions.

- Align the stream with the Superteams initiative to provide clients with clear guidelines for achieving better outcomes.

Audience

- Mega funds show strong interest in expanding dashboards to address long-horizon systemic risks, such as geopolitical shocks and enhanced risk coverage.

- Middle-size funds express appeal to address risk coverage through the osmosis or cascade effect from larger to smaller funds.

- This expansion includes the incorporation of a more dynamic KPI framework to improve responsiveness and insight.

What’s the value in this working group?

- Value is generated through more informed assessments of performance and more effective responses to emerging outcomes.

- This includes producing more accurate probability estimates and evaluating impairment and other risks with greater precision.

- It also enhances the detection of systemic threats and improves the quality of decision-making signals.

Approach we take

- Design and integrate relevant measures into dashboards to enhance clarity and decision-making.

- Establish a clear process and provide training to support the effective creation of dashboards and forecasts.

- Generate new projections of risk and develop refined risk metrics to improve forward-looking analysis.

- Validate forecasting approaches by assessing the reliability and relevance of the outputs.

Why join this working group?

- Co-develop next-generation dashboards that integrate foresight, risk, and performance indicators.

- Strengthen risk coverage for long-horizon and systemic shocks such as geopolitical or technological disruptions.

- Build better beliefs and more accurate inputs for investment and business decisions.

- Gain tools to test and validate forecasts, enhancing the reliability and relevance of decision signals.

Please contact Anastassia Johnson to know more.

Related pages

Pensions aren’t what they used to be… a glimpse into the future

The Power of Teams

Risk 2.0: The wrong type of snow