The investment industry’s business model relies on clients trusting the industry’s strong comprehension of reality. As noted in the precursor Systemic Risk: deepening our understanding, the industry has only a qualified basis for such claims.

Smart minds build models and manage money, breaking down reality into manageable parts using historical data. However, aggregating these models doesn’t yield true comprehension. We argue that understanding the whole system is crucial.

In this paper, we discuss the growing concern around systemic risk, and how we can modify our risk models, investment practices, and portfolio construction to address it.

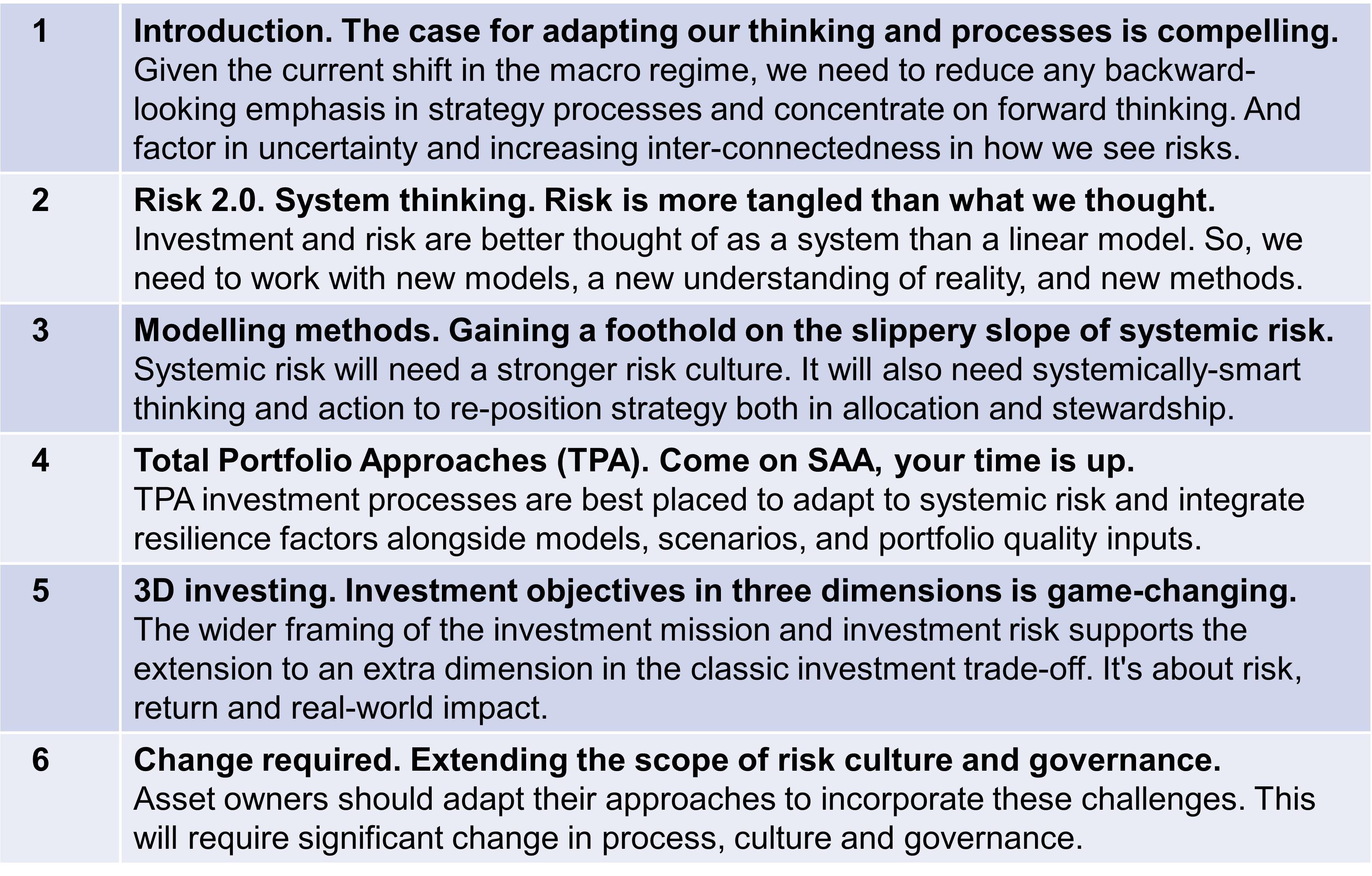

The outline of the paper is as follows: